Income Tax is leviable in India on gains earned on transfer of assets, tangible or intangible depending upon the period of holding, nature of asset, investment of sale proceeds, deemed transfer of consideration and many other situations. Capital gains tax is one form of taxing inflation gains at the time of transfer of asset. However gains on transfer of business assets are not covered under this capital gains levy. Gains on transfer of some of the assets like personal assets, agricultural lands, Bonds specially exempted by the Govt. are not liable for Capital Gains Tax.

Hence it is important to know about transfer, capital asset, business asset, personal asset, period of holding, nature of investment of sale proceeds etc.

Capital Asset: All assets whether tangible or intangible which are not used in business, personal assets.

Includes:

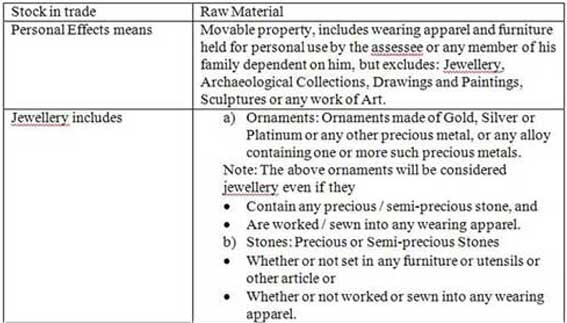

- Property of any kind, whether or not connected with business or profession. Stock in Trade,

- Gold, jewellery, ornaments made of gold, silver, platinum or any other precious metal sewn into any wearing apparel

Excludes:

- Personal Effects,

- Rural agricultural land in India,

- 61/2% Gold Bonds 1977, 7% Gold Bonds 1980 & National Defence Gold Bonds, 1980,

- Special Bearer Bonds, 1991,

- Gold Deposit Bonds.,1999.

Meanings: For the above purpose